Direct Asia Car Insurance

DirectAsia's plans benefits and competitively priced plans can entice both the budget and value seeking traveller, in addition to offering some notable perks not often seen in travel insurance. However, depending on which kind of plan you're looking for, DirectAsia may give you a varying amount of bang for your buck, which means you may have to pay more to get a better value plan. Below, we break down each of DirectAsia's travel insurance plans so that you can make the right call when planning your next trip out of Singapore. Table of Contents.Direct Asia Travel Insurance: What You Need to KnowDirectAsia offers three travel insurance plans for Singaporeans looking to travel: the Travel 150, 200, 500 and annual-only 1000 plan, with the 500 and 1000 Plans being the clear standouts due to their price and coverage. While they don't provide the highest value possible, Direct Asia's plans do offer some notable perks that can entice families and adventurous travellers. These include providing the same medical and accident coverage limits for children as for adults, extreme sports and sports equipment coverage, coverage for your domestic worker and trip cancellation benefits due to haze or reluctance to travel following a terrorist attack.

- Direct Asia Insurance Singapore Travel

- Direct Asia Car Insurance Hong Kong

- Direct Asia Commercial Car Insurance

DirectAsia's focus on trip inconvenience coverage and comepetitive pricing are the hallmark of this insurer's travel insurance policies. DirectAsia Travel 150 and Travel 200 PlanThe DirectAsia Travel 150 and 200 Plan's most notable feature is their market-beating coverage for trip delays (S$3,000 and S$6,000), which more than double the average amount of trip delay coverage provided by other insurers' budget and mid-tier travel insurance plans. Other than that, however, DirectAsia's cheapest and mid-priced plans fail to make a resounding impression. Apart from their great coverage for trip delays, they generally provide below-average coverage in many other important areas like personal accident/death, medical expenses, trip cancellations, and baggage loss/damage. However, they tend to be on the pricier end given the amount of protection these two plans offer compared to their competitors.The Travel 150 Plan, which is DirectAsia's budget travel insurance plan, lacks an annual/multi-trip policy, making the 200 plan a better alternative for individuals who travel out of Singapore more than 3 to 5 times a year. Moreover, the 150 plan tends to be priced at the same level as higher value plans, making it difficult to find a compelling reason it over other options on the market like the that offer considerably better medical and trip inconvenience benefits.

Direct Asia Insurance Singapore Travel

GrabHitch Coverage + Save Up To $343 at Direct Asia Insurance. Direct Asia Insurance covers now GrabHitch drivers. So if you are one of them, this is your chance to purchase a quality policy, save up to $343 and feel secure when driving. Head to the landing page and get your quote now. How to disable avg free.

The Travel 200 Plan is more competitively priced than its sibling, the Travel 150 Plan, as it tends to be the cheapest single and annual trip option for mid-tier plans. However, it is consistently given a run for its money in terms of value for single trip policies by, which tends to offer generally better overall coverage for similar prices. Even though it is the cheapest among annual policies, it is outclassed by the similarly-priced, a very high-value plan that gives you among the most bang for your buck in the entire business tier of travel insurance policies.

DirectAsia Travel 500 PlanThe DirectAsia Travel 500 plan is a particularly good choice for travellers seeking annual/multi-trip policies that are affordable while packing a punch. It is one of the cheapest premium plans for this kind of policy, regardless of destination, and has one of the highest-value premium plans on the market for annual trips.

It offers S$15,000 of trip cancellation and curtailment, a combined S$525,000 for international and domestic medical expenses and a few extra benefits including pet hotel cover, rental car excess and sports equipment coverage. However, though the benefits are plenty, its high value comes from its low price rather than high limits on benefits. This means travellers who are seeking to maximise better coverage may fare better with other insurers.One alternative you may want to consider when making your decision is the FWD First Plan, which is a good value option that is similarly priced to the DirectAsia Travel 500 Plan and puts a greater emphasis on coverage for medical expenses and baggage loss/damage as well as unlimited coverage in case of emergencies. For a slightly higher price, you may also consider the or the for even better coverage at a great value. DirectAsia Travel 1000 PlanDirect Asia's Travel 1000 Plan is its annual-only option that can benefit frequent travellers looking for a high-value trip inconvenience focused policy.

Direct Asia Car Insurance Hong Kong

Its premiums cost 30-40% below its peer average, yet it has 35% more trip inconvenience coverage than other premium plans on the market. Additionally, it can appeal to solo and family adventure enthusiasts with its S$5,000 and S$12,500 sports equipment coverage (highest on the market) and S$1,500 car rental excess coverage.

You will also find above average medical coverage of S$1,050,000.One potential setback for DirectAsia's 1000 plan is that though its medical coverage is not paltry by any means, it is not necessarily outstanding compared to other players in the market. Those who are willing to pay for high medical and personal accident benefits may fare better with insurers such as. Sports CoverageDirectAsia offers extreme sports coverage only for its annual plans and will raise your premiums by around S$65-S$100, depending on destination and plan selected. However, most of the accepted activities must be done with a professional guide, including trekking, scuba diving, rafting/kayaking, parachuting/skydiving, rock climbing, hang gliding and hot air ballooning. There are a variety of sports that are included even if you don't purchase the annual policy add-on including golfing, hiking, cycling, fishing, water polo and swimming. You can also purchase S$5,000 of sports equipment coverage for an additional S$50.14.

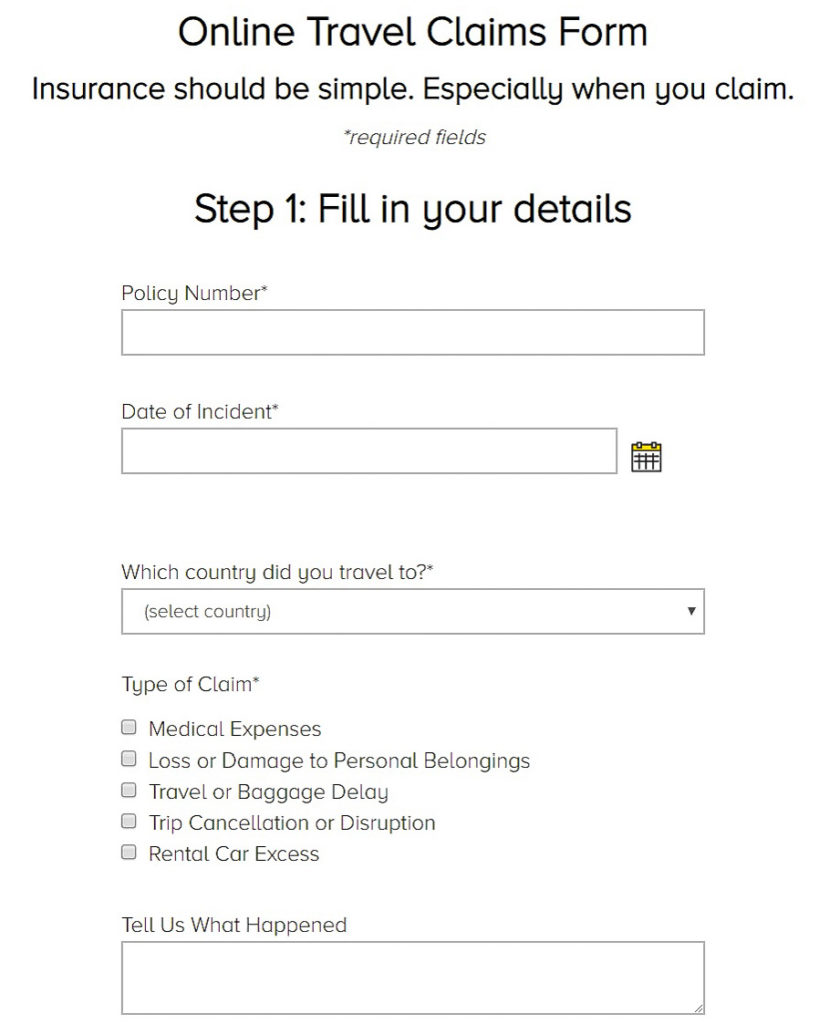

Claims InformationTo submit a claim with DirectAsia, you have to call them at their claims number and have ready your flight itinerary and any other supporting documents you'll need. You will be assigned a claims representative who will help you process everything.

Direct Asia Commercial Car Insurance

Alternatively, you can also Email or mail them your claim form and documents. Coverage Benefits000Industry AveragePersonal Accident & DeathS$100,000S$300,000S$500,000S$500,000S$329,300MedicalS$155,000S$210,000S$525,000S$1,050,000S$781,000Emergency Medical/Evacuation/RepatriationS$1,500,000S$1,500,000S$1,500,000S$1,500,000S$1,043,000Trip CancellationS$3,000S$10,000S$15,000S$25,000S$12,900Trip DelaysS$1,000S$1,000S$1,500S$2,000S$1,300Baggage Loss DamageS$1,000S$3,000S$5,000S$7,500S$5,700Baggage DelayS$1,000S$1,000S$1,000S$1,000S$1,100. Advertiser Disclosure: ValueChampion is a free source of information and tools for consumers. Any information relating to financial products are for reference and general information only, and do not have regard to specific needs of any individuals. Consumers should inquire with the relevant financial institution if they have any questions, including eligibility to buy financial products. ValueChampion is not to be construed as in any way engaging or being involved in the distribution or sale of any financial product or assuming any risk or undertaking any liability in respect of any financial product.

Some of the offers that appear on this website are from companies which ValueChampion receives compensation. This compensation may impact how and where offers appear on this site (including, for example, the order in which they appear). The site does not review or include all companies or all available products.ValuePenguin is not in control of, or in any way affiliated with, the content displayed on this website.